A tangible asset with meaning

Premium diamonds offer a distinct approach to wealth diversification, grounded in tangible assets that combine intrinsic value with an emotional dimension.

Much like fine art or classic cars, diamonds unite technical excellence with personal attachment. By reconciling patrimony and passion, they restore a human dimension to asset ownership, beyond purely financial considerations.

Rare, specialized, and historically difficult to access, premium diamonds appeal to those seeking diversification, exclusivity, and meaning within a long-term wealth perspective.

Why include premium diamonds in your wealth strategy?

- 🌍 Diamonds are a globally recognized asset, valued under internationally standardized criteria.

- 💰 High value concentrated in a small volume, easy to store and transport.

- 🏛️ Diamonds are a well-established global market, traded on international professional exchanges.

- 🏦 Diamonds are a safe haven currency in times of crisis. It is a real, healthy market.

- 💎 High-quality diamonds are by definition limited, with a structurally constrained supply and dwindling resources.

- 🗝️ Easily transferable across generations, diamonds unite enduring value, emotional significance, and the pleasure of wear when set into jewellery.

Buying diamonds at the source

1. The true value of the Woodeex model

The investment approach we offer is fully aligned with Woodeex’s philosophy and value proposition: enabling the acquisition of diamonds directly at the source, under the most favorable market conditions.

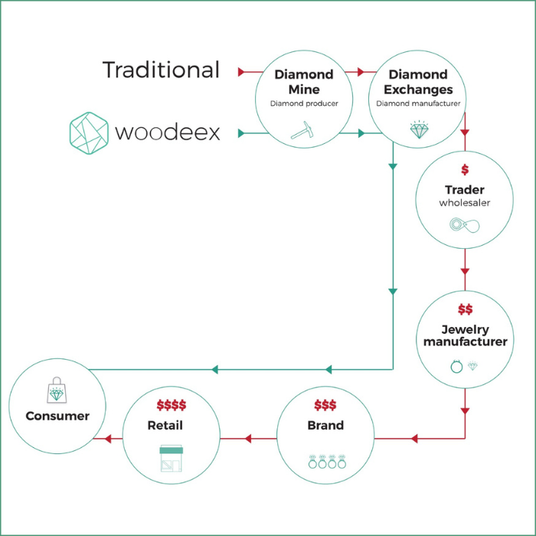

The diamond market has historically been dominated by multiple intermediaries and high distribution margins, distancing end buyers from the true market value of the stones.

The Woodeex model provides direct access to diamantaires’ inventories—an environment typically inaccessible to the general public.

An asset valued at 1 in a retail setting can be acquired three to five times lower, not because the product differs, but because the distribution channel does.

2. Accessing the professional diamond market

Where value is formed before retail.

This chart illustrates the Woodeex sourcing model compared with the traditional diamond supply chain, highlighting where value is preserved by eliminating successive intermediaries.

3. What Woodeex makes possible

- Direct access to the professional diamond market

- Selection of premium diamonds at the source, both on-market and off-market

- Best market prices, no middlemen, no retail markups.

- Purchase conditions normally reserved for professionals

- Confidentiality and discretion at every stage

- Personal guidance from professional diamantaires

How it works - Bespoke Service

What this service is not

⚠️ DISCLAIMER

- It is important to emphasize that we exclusively offer physical diamonds, delivered directly to our clients

- Under no circumstances does this service constitute a financial product and does not imply any promise of return, performance, or exit. It is neither a structured investment solution nor a traditional financial instrument.

- When we refer to “investment diamonds,” we are solely describing direct access to premium assets, typically reserved for professionals, under privileged market conditions.

- The value lies in access to the source: acquiring diamonds of the highest quality at price differentials that can reach up to a threefold gap compared to retail pricing.

Selection criteria aligned with a patrimonial approach

The diamonds selected as part of this service meet strict quality standards, distinct from those of a purely pleasure-driven purchase.

The criteria applied prioritize rarity, value stability, and international recognition, in line with professional market standards.

All diamonds offered as part of this service are accompanied by certifications recognized by the professional diamond industry.